If you’ve found yourself more frequently using Lyft for business travel, you’re not alone. Certify’s latest quarterly summary shows how the ride hailing app has impacted work travel trends.

Before the advent of the sharing economy, business travelers typically relied on car rentals and taxis to get around their work travel destinations. But high costs and lack of flexibility have always plagued these services. As such, the introduction of ride hailing apps like Uber and Lyft have initiated changes across the transportation industry.

For work travelers, this means more expense receipts from ride hailing apps than from traditional taxi or car rental companies. Certify’s most recent SpendSmartTM report, analyzing business expense receipts from the first quarter of 2018, covers this shift in trend, and we will summarize their findings here.

Lyft vs. Uber

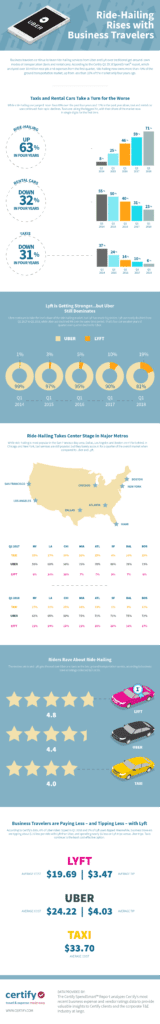

Lyft and Uber need no introduction. When it comes to ride hailing apps, these two are the biggest players in the industry. Back in the first quarter of 2014, Uber ruled the ride hailing realm, raking in 99% of road warrior usage to Lyft’s 1%. Since then, Lyft’s market has grown exponentially. In the first quarter of 2018, Lyft claimed 19% of the business travel expense pie and Uber 81%, up and down 9% from the previous year, respectively.

So why the sudden spike in Lyft expense receipts? Certify’s summary also reports on ratings given by ride hailing users. This quarter, Lyft collected an impressive 4.8 out of 5 stars, proving that it’s won the hearts of many road warriors. Not to mention, Lyft’s partnerships with American Express Global Business Travel and Carlson Wagonlit Travel elevate the brand’s visibility in the travel industry.

At the moment, it’s too soon to tell if Lyft will overtake Uber, or if both will reach a plateau and share the ride hailing market more evenly. But it is clear that ride hailing apps are here to stay, and they’re shaking up how business travelers get from point A to B.

Ride Hailing Apps vs. Traditional Transport

While increased Lyft usage has taken a chunk out of Uber’s wallet, the overall rise of both apps has yielded less car rentals and taxi rides. In Certify’s 2014 Q1 report, ride hailing apps accounted for 8% of ground transport receipts expensed by business travelers. In contrast, for the first three months of 2018, that number had increased to 70.5%.

This remarkable increase has seen a drop in car rentals (from 55% to 23.5%) as well as in taxi usage (from 37% to 6%). More and more, road warriors are relying on ride hailing apps as their primary means of transportation within a work travel destination.

When accounting for the rise of ride sharing apps and the decline of taxis and car rentals, cost and flexibility seem to be the most influential factors. Lower rates, especially when taking advantage of ride share features, go a long way in business travel budgets. Plus, getting dropped off for a meeting is preferred to finding parking, and requesting a ride before you’re even on the street sure beats hailing a taxi.

Notable Trends by Region

Across the U.S., these trends are fairly consistent. Uber reigns supreme with Lyft making major strides in increasing usage. In the meantime, taxi usage and car rentals have been disappearing from expense reports.

Of the eight urban areas reviewed by Certify, San Francisco saw the most ride hailing app usage, while New York experienced the least. For the former, Lyft boasted a 20% increase in usage from the previous year’s report, while the Uber market decreased by 17%. Taxi services decreased from 4% of business travel receipts to 1%.

In New York, both Lyft and Uber experienced modest increases of 5% and 3%, respectively, and taxi usage dropped by 8% (though still finishing with 27% of the market). While the two coasts appear to be feeling the impact of ride hailing apps at different rates, they, and everywhere in between, are both certainly experiencing it.

When it comes to the business travel industry, the growth of the ride hailing market is an exciting change. No longer at the mercy of expensive car rentals and taxi rides, road warriors can take advantage of the lower rates and ease of use provided by ride hailing apps. Plus, both Lyft and Uber have “for business” elements, designed to make integrating work travel with their services a seamless process. We’re looking forward to seeing what next quarter’s analysis has to report on this expanding industry.

Business Travel Life

Business Travel Life is an online resource supporting the road warrior lifestyle. We give business travelers the tools they need to maintain their wellness and productivity when traveling. The topics we cover include business travel tips, travel workouts, healthy travel hacks, travel products, general travel tips, and industry trends. Our goal is to make business travel a healthier experience – and to make healthy travel practices more accessible to all road warriors.